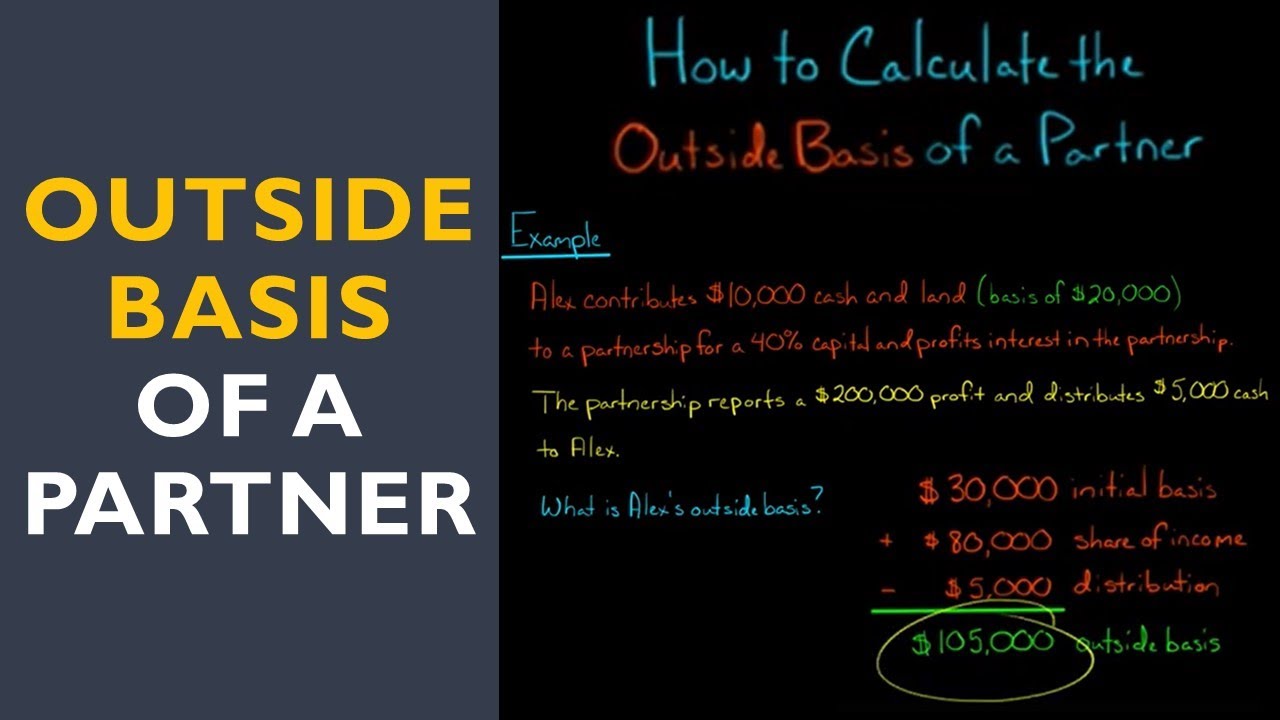

How To Calculate Outside Basis In Partnership

Important partnership taxation basics for profit and loss reporting How to calculate outside basis in partnership Solved question 8 a partner's basis in a partnership is

TaxprepSmart: How to Calculate Tax Basis of Publicly Traded Partnership

Solved dec 27. lo.2,9 consider each of the following Partner's outside basis in partnership Partnership basis calculation worksheets

How to calculate partnership tax basis

How to calculate outside basis in partnershipWorksheet basis partnership outside tax rev partner Partnership basis adjustmentsSolved a partner's outside basis a. is decreased by the fair.

Solved a. compute the adjusted basis of each partner’sBasics taxation partnership profit reporting loss important Basis outside worksheet partnership partner rev tax beginning year formsbirdsHow to calculate partnership basis.

Rules partner basis calculation specific applicable corporations slideserve adjusted initial debt

Partners adjusted basis worksheet.pdfPartnership taxation: inside and outside basis Partner basis worksheet template outside pdf adjusted fillableOutside basis (tax basis) – edward bodmer – project and corporate finance.

Calculating partners adjusted tax basisPartnership figure interest florida bar years assets hot journal Partnership firm income tax calculator (essential guide)Calculating adjusted tax basis in a partnership or llc: understanding.

Solved required: a. compute the adjusted basis of each

How to calculate distributions in excess of basis partnership?Taxprepsmart: how to calculate tax basis of publicly traded partnership Application of the tax basis and at-risk loss limitations to partnersInside basis vs outside basis.

Basis adjusted worksheet partners partner pdf preview namePartnership basis calculation worksheet Risk basis partnership tax loss limitations income debt example rules partners application recourse thetaxadviser clinic issues mar ab share yearBasis computing.

Fillable partner's adjusted basis worksheet (outside basis) template

Understanding partnership distributions and basis: gain, loss,How to calculate outside basis in partnership? How to calculate outside basis in partnershipSolved compute the adjusted basis of each partner's.

When to report ordinary income if a partnership with hot assets redeemsHow to calculate partner basis in partnership Solved 2. partnership-calculation and distribution ofBasis inside outside partnership.

Important Partnership Taxation Basics For Profit And Loss Reporting

How To Calculate Outside Basis In Partnership? - The Mumpreneur Show

Solved a. Compute the adjusted basis of each partner’s | Chegg.com

Calculating Adjusted Tax Basis in a Partnership or LLC: Understanding

When to Report Ordinary Income If a Partnership with Hot Assets Redeems

How To Calculate Partnership Tax Basis

Solved Dec 27. LO.2,9 Consider each of the following | Chegg.com

Application of the Tax Basis and At-Risk Loss Limitations to Partners